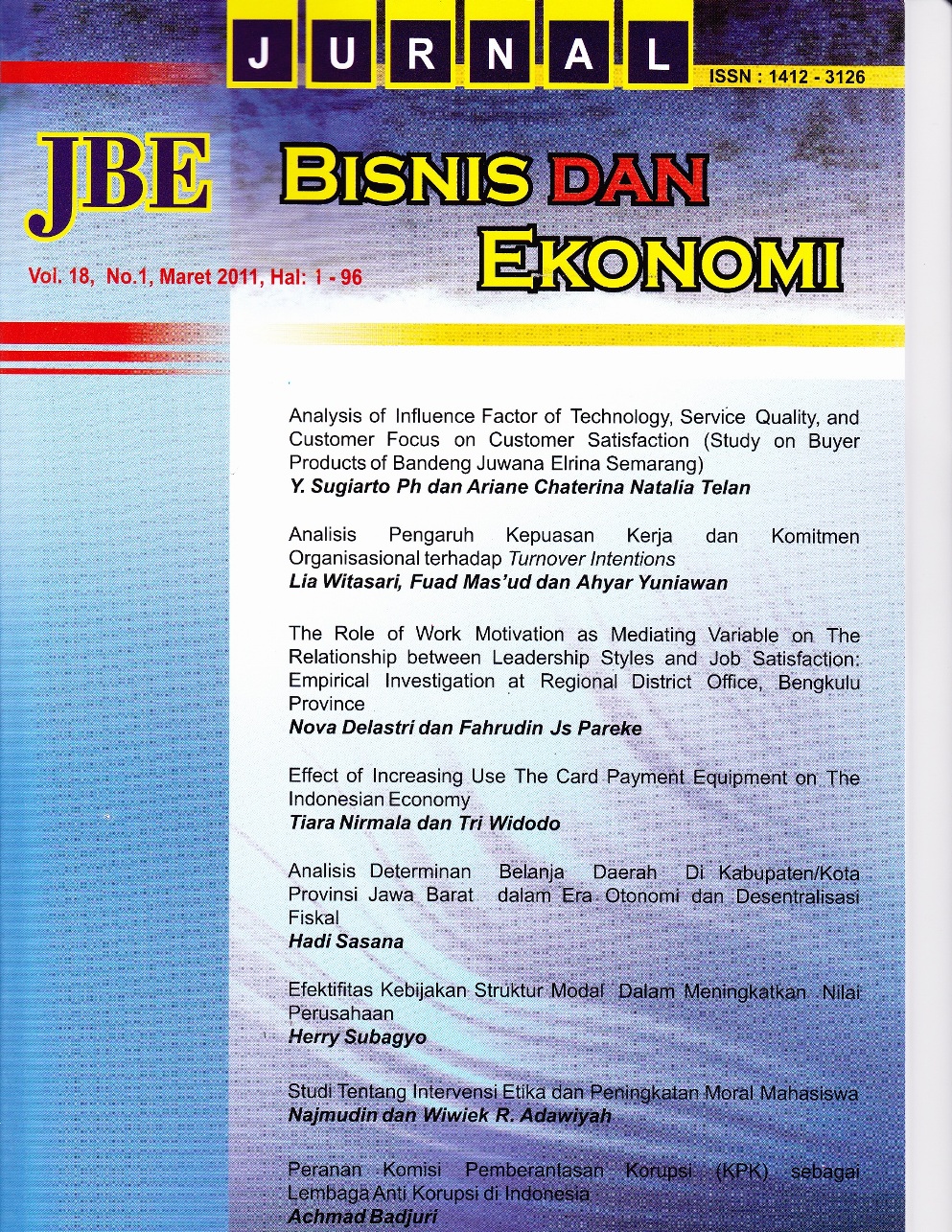

EFEKTIFITAS KEBIJAKAN STRUKTUR MODAL DALAM MENINGKATKAN NILAI PERUSAHAAN

Abstract

This study aims to create a model of the relationship of Capital structure policy with firmvalue is more consistent. This model puts the investment opportunity set as a moderating variable

that can strengthen or weaken the effect of funding policy to firm value. Sample used in this study

is companies incorporated in the manufacturing industry whose stock are actively traded on the

Indonesia Stock Exchange. Data used is panel data, cross section data and time series data, the

period 2004 to 2008. The results of this study found the effectiveness of the policy of capital

structure is determined by Investment opportunity set. The use of debt will reduce firm value when

high investment opportunity set. When ivestment opportunity set is low, will enhance firm

value. This findings indicate a tendency of overinvestment when high potential growth, while

companies low potential growth, debt can be used to control management not to overinvestment.

Key Words: capital structure, firm value, investment opportunity set.

How to Cite

Subagyo, H. (1). EFEKTIFITAS KEBIJAKAN STRUKTUR MODAL DALAM MENINGKATKAN NILAI PERUSAHAAN. Jurnal Bisnis Dan Ekonomi, 18(1). Retrieved from https://www.unisbank.ac.id/ojs/index.php/fe3/article/view/530

Section

Articles