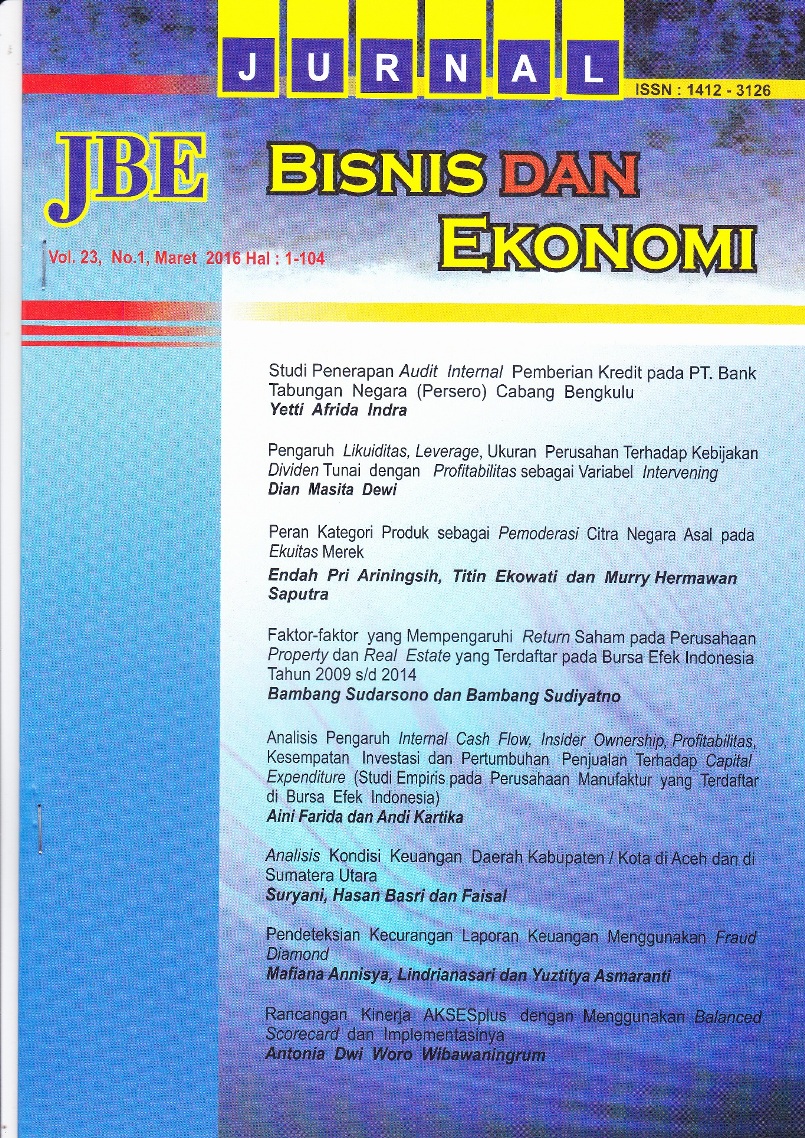

PENDETEKSIAN KECURANG LAPORAN KEUANGAN MENGGUNAKAN FRAUD DIAMOND

Abstract

This study aimed to analyze the factors that encourage fraudulent financial reports with analysis of diamond fraud. This research analyzes the influence of variable pressure proxied by financial stability, external pressure, financial targets, the opportunity proxied by nature of industry, razionalization proxied by audit opinion, and the capability to replace any directors proxies against financial statements fraudulent. The sample was a total of 27 real estate companies and real estate listing on the Indonesian Stock Exchange in the period 2010-2014. The results showed that the variables of financial stability as measured by the ratio of the change in total assets showed a positive influence on fraudulent financial statements. This study did not find a variable external pressure as measured by the leverage ratio, financial targets as measured by return on assets, nature of industry as measured by the ratio of inventory changes, the audit opinion as measured by obtaining an unqualified opinion with clarifying language, and capablity measured with the change of directors influence on fraudulent financial statements.

Keywords: Fraud diamond, fraudulent financial statement, financial stability, external pressure, financial targets, nature of industry, audit opinion.